Bitcoin Mining Difficulty Hits All-Time High in 2025

This article sets the stage for a deeper exploration of how regulatory landscapes, technological breakthroughs, and market dynamics are influencing the direction of digital assets. By understanding these foundational elements, readers can better navigate the fast-changing ecosystem and approach new financial trends with clarity, confidence, and informed perspective.

From analyzing price movements to uncovering innovative blockchain projects, Crypto Nest equips investors and enthusiasts with the knowledge needed to navigate the fast-paced crypto environment confidently. This approach ensures that every decision is backed by reliable data and thoughtful analysis.

In a space where technology and finance converge, opportunities emerge daily for those who are prepared. Our mission is to illuminate these possibilities, helping readers make strategic choices and stay ahead in the evolving world of digital currencies.

At Crypto Nest, our mission is to break down these complexities and make the world of cryptocurrency accessible to everyone. By offering clear explanations, structured insights, and practical examples, we aim to transform confusing concepts into understandable knowledge. This approach empowers readers to build confidence and make informed decisions in an industry that changes rapidly.

Whether you’re just stepping into blockchain technology or already diversifying your investment portfolio, having the right guidance can make all the difference. This guide brings together the key principles, market dynamics, and emerging trends that every learner or investor needs to know. With each concept connected to real-world applications, you gain a stronger understanding of how crypto functions beyond charts and price movements.

As you explore the following sections, you’ll uncover strategies, tools, and insights designed to enhance your financial literacy and long-term planning. From identifying secure investment opportunities to recognizing risks and market patterns, this guide will help you navigate the evolving digital economy with clarity. Ultimately, this knowledge prepares you to engage with cryptocurrency in a meaningful and strategic way that supports your financial goals

Investors and enthusiasts must not only understand market trends but also grasp the technological and security aspects of crypto. From managing wallets and private keys to recognizing phishing schemes and fraudulent platforms, every detail matters in safeguarding digital holdings. By equipping readers with practical guidance and actionable insights, Crypto Nest helps users make informed decisions that protect both their assets and their confidence.

With the right approach, navigating the world of digital finance becomes a manageable and rewarding endeavor. Learning to balance risk with opportunity ensures that investors can grow their portfolios without falling prey to common pitfalls. This article will provide a comprehensive look at effective security measures, scam awareness, and strategies to maintain control in the fast-paced crypto environment.

Our team investigates how decentralized systems are reshaping industries, from finance and art to gaming and data management.

We’re passionate about delivering analysis that matters, combining research with real-world applications and expert commentary.

In an age of misinformation, Crypto Nest stands as your trusted source for clarity and truth in the crypto sphere.

Discover the power of knowledge — and let Crypto Nest be your compass in the blockchain world

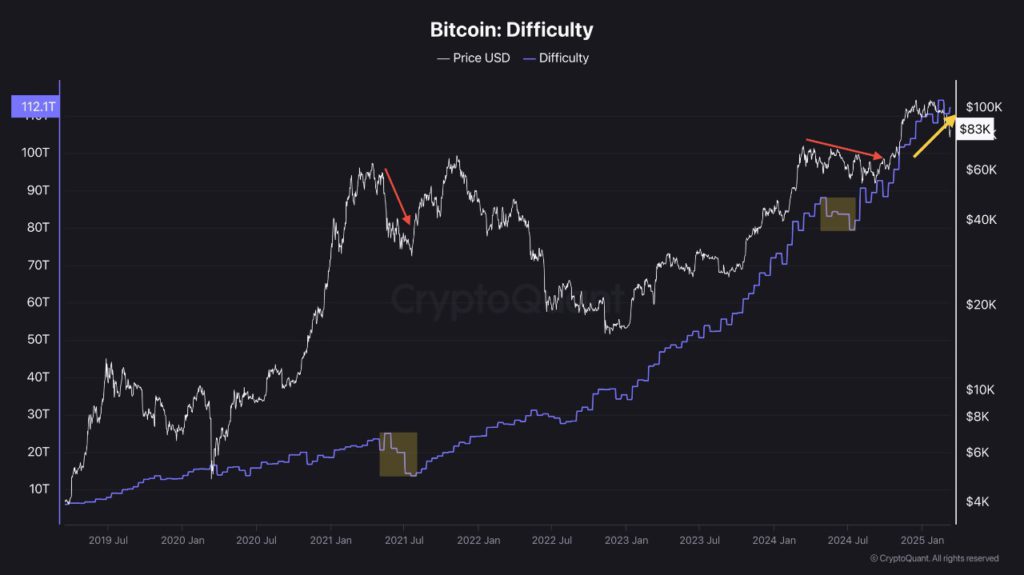

In 2025, BTC (BTC) mining difficulty reached an unprecedented peak, hitting 127.6 trillion, as reported on August 3, 2025, reflecting the immense computational power now securing the BTC network.

This milestone underscores the growing competition among miners and the robustness of BTC’s decentralized system.

As of August 3, 2025, with BTC trading between $50,000 and $80,000, this surge in difficulty has significant implications for miners, investors, and the broader crypto ecosystem.

This article explores the reasons behind the all-time high in BTC mining difficulty, its impact on the market, and what it means for the future of BTC.

What Is BTC Mining Difficulty?

BTC mining difficulty measures how challenging it is for miners to find a valid hash for a new block on the BTC blockchain.

It adjusts automatically every 2,016 blocks (approximately every two weeks) to maintain an average block time of 10 minutes.

A higher difficulty indicates more computational power (hashrate) is required to solve the complex mathematical puzzles that validate transactions and earn block rewards.

This self-regulating mechanism ensures BTC’s predictable issuance and protects its scarcity, a key feature of its value proposition as “digital gold.”

How Difficulty Works

-

Hashrate Influence: As more miners join the network or deploy advanced hardware, the hashrate (total computational power) increases, raising difficulty to slow block production.

-

Adjustment Mechanism: If the hashrate drops (e.g., miners leave due to unprofitability), difficulty decreases to maintain the 10-minute block interval.

-

Stock-to-Flow Ratio: BTC’s difficulty adjustments maintain its high stock-to-flow ratio (currently ~120, twice that of gold), ensuring low new supply and price stability.

The 2025 Milestone: 127.6 Trillion

BTC’s mining difficulty surged to an all-time high of 127.6 trillion in early August 2025, driven by a record hashrate of 933.61 exahashes per second (EH/s).

This peak followed a year of intense miner activity, with nine difficulty increases and five decreases in 2025, resulting in a net 32.24% gain year-to-date. Key factors contributing to this milestone include:

1. Surging Hashrate

-

The seven-day average hashrate reached 918–933.61 EH/s in 2025, nearing its all-time peak of 925 EH/s.

-

Miners deployed newer, more efficient Application-Specific Integrated Circuits (ASICs), boosting computational power.

-

Public mining companies like CleanSpark and MARA expanded operations, with CleanSpark reaching 45.6 EH/s and MARA mining 950 BTC in May 2025.

2. Post-Halving Dynamics

-

The April 2024 BTC halving reduced block rewards from 6.25 BTC to 3.125 BTC, increasing miners’ reliance on transaction fees and higher BTC prices for profitability.

-

Despite lower rewards, BTC’s price recovery (from $17,000 in 2022 to $50,000–$80,000 in 2025) attracted new miners, driving hashrate and difficulty higher.

3. Technological Advancements

-

Innovations in mining hardware, such as next-generation ASICs, improved efficiency, allowing miners to contribute more hashrate with lower energy costs.

-

Access to low-cost energy sources, particularly for large-scale miners, sustained profitability despite rising difficulty.

4. Institutional and Corporate Involvement

-

Public miners like MARA accumulated 49,179 BTC as treasury assets, signaling long-term confidence in BTC’s value.

-

Institutional adoption, including BTC ETFs and corporate treasury strategies, bolstered miner optimism, encouraging investment in mining infrastructure.

Impact on Miners

The record-high difficulty has significant implications for BTC miners:

-

Increased Costs: Higher difficulty requires more computational power and energy, raising operational costs. Miners with outdated hardware or high energy costs face tighter margins.

-

Consolidation: Smaller miners may exit or merge with larger operations, as only those with efficient equipment and cheap energy remain competitive.

-

Profitability Pressures: With hashprice (revenue per unit of hashrate) at $58.67 and transaction fees low (~2 sat/vB or $0.30), miners rely on BTC’s price appreciation to stay profitable.

-

Strategic Shifts: Some miners, like MARA, diversify into high-performance computing (HPC) or lend BTC for yield, while others hold mined coins as treasury assets.

Despite these challenges, a projected 3% difficulty drop to ~123.7 trillion on August 9, 2025, could offer temporary relief by making block rewards easier to earn.

Impact on the BTC Network

The all-time high difficulty strengthens BTC’s ecosystem:

-

Enhanced Security: A higher hashrate makes the network more resistant to 51% attacks, reinforcing trust in BTC’s decentralization.

-

Scarcity Preservation: Difficulty adjustments maintain BTC’s stock-to-flow ratio, with ~94% of its 21 million BTC already mined, supporting its value as a scarce asset.

-

Market Sentiment: Rising difficulty signals miner confidence, often correlating with bullish price trends, as seen in past cycles (e.g., 2021 bull run).

However, low on-chain activity (e.g., minimal transaction fees) suggests a divergence between mining infrastructure growth and network usage, which could temper short-term price gains.

Implications for Investors

For crypto investors, the record difficulty has mixed implications:

-

Bullish Signal: Historically, rising difficulty and hashrate precede bull runs, as seen in 2021 when nine consecutive positive adjustments coincided with BTC’s $69,000 peak.

-

Price Pressure: Higher difficulty reduces miner profitability, potentially leading to sell-offs if prices stagnate. For example, 30,000 BTC left miner wallets from November 2023 to July 2024 during unprofitable periods.

-

Long-Term Confidence: Long-term holders (LTHs) show a 357% profit ratio in July 2025, with minimal selling, indicating strong conviction in BTC’s value.

Investors using strategies like Dollar-Cost Averaging (DCA) can capitalize on volatility, buying during dips to offset potential corrections.

The Crypto Landscape in 2025

As of August 3, 2025, BTC’s mining difficulty reflects a maturing market. The network’s hashrate growth, driven by technological advancements and institutional involvement, underscores BTC’s resilience post-2024 halving.

However, miners face challenges from rising costs and low transaction fees, while investors navigate a market influenced by global liquidity and ETH ETF growth.

A projected difficulty drop on August 9 offers short-term relief, but the long-term trend remains upward, signaling robust network health.

What to Do as a Crypto Enthusiast

-

Stay Informed: Monitor difficulty and hashrate trends using platforms like CoinWarz, CryptoQuant, or Blockchain.com.

-

Invest Wisely: Use DCA to mitigate volatility, focusing on BTC’s long-term value as a scarce asset.

-

Secure Assets: Store BTC in a hardware wallet (e.g., Ledger Nano X) to protect against exchange risks. Back up seed phrases offline.

-

Understand Cycles: Recognize that difficulty spikes often precede price rallies, but short-term corrections are possible.

-

Explore Mining: For advanced users, research cloud mining or low-cost energy solutions, but beware of high costs and scams.

As new technologies and regulations shape the market, those who stay informed will lead the future of finance.

Whether you’re an investor, developer, or enthusiast, every step you take brings you closer to mastering this digital frontier.

Stay connected with Crypto Nest, where insight meets innovation

Understanding the practical applications behind each project provides a strategic advantage, helping you navigate the digital economy with clarity and purpose.

By embracing learning, observation, and critical thinking, you can turn the evolving crypto landscape into a platform for growth, insight, and lasting impact.

Grasping the interplay between technology, finance, and community enables smarter decisions and a clearer perspective on emerging opportunities.

By staying engaged and applying what you learn, you transform information into strategy and insight into meaningful progress in the blockchain world.